Corporate Tax Return Due Date 2025 Maharashtra. The new vat audit form — 704 is an important step toward improving tax accountability and transparency. Every dealer registered under the maharashtra state tax on professions, trades, callings and employments act, 1975 (the act) required to file monthly or.

While the filing deadline is. The new vat audit form — 704 is an important step toward improving tax accountability and transparency.

Corporate Tax Return Due Date 2025 Maharashtra Images References :

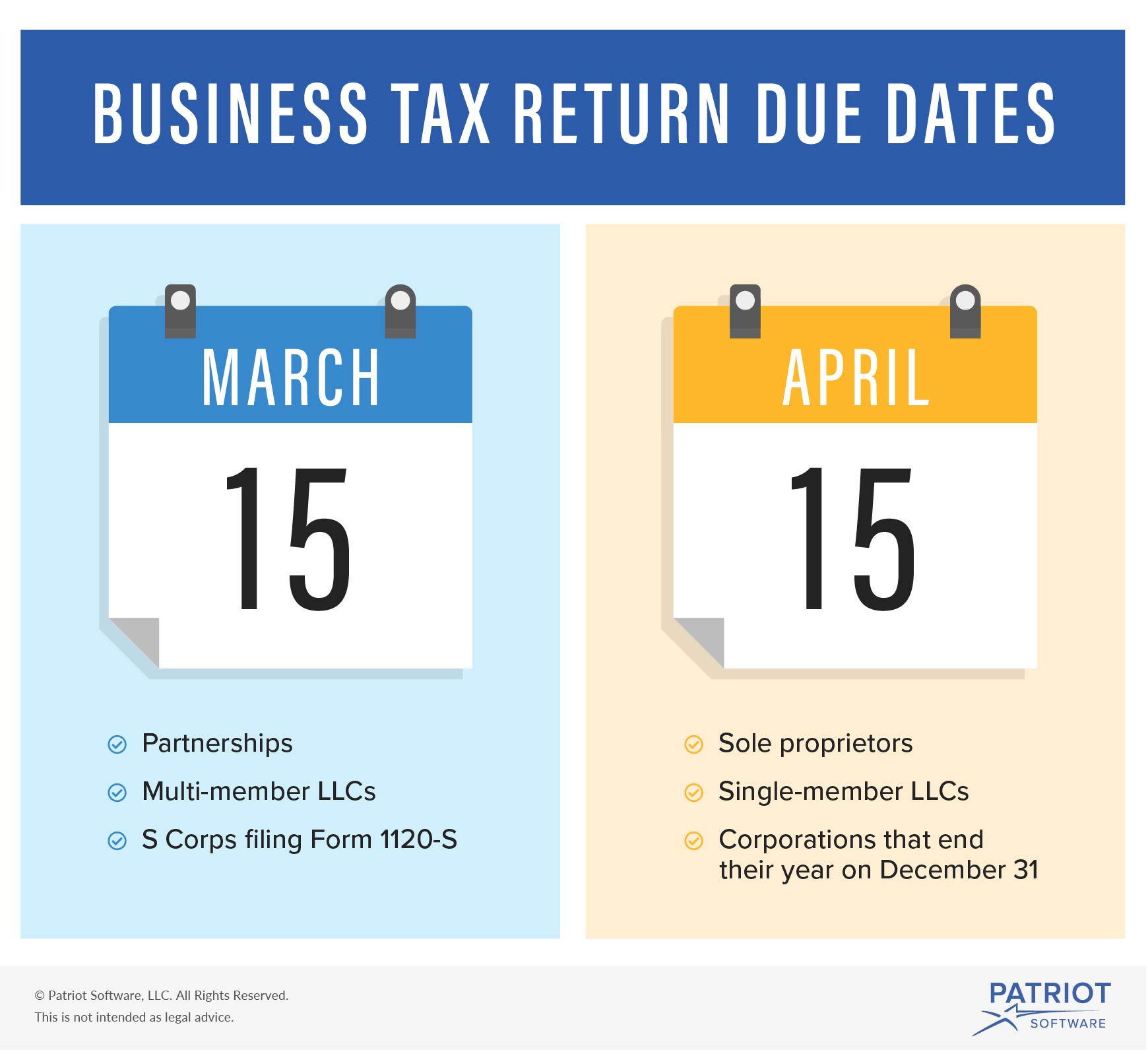

Corporation Tax Return Due Date 2025 Maxie Sibelle, Whether your tax liability is under or over rs.

Source: chadbgisella.pages.dev

Source: chadbgisella.pages.dev

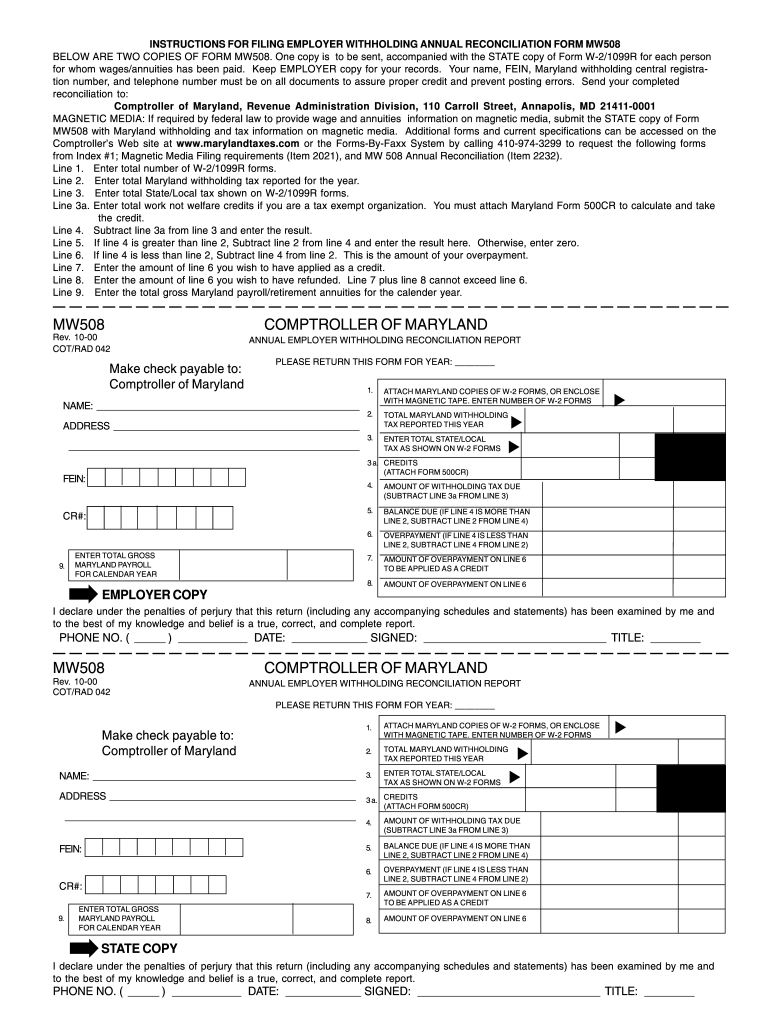

Corporate Tax Return 2025 Due Date 2025 India Raina Chandra, The amendment specifically targets employers who faced technical difficulties in filing returns between 1st march 2025 to 31st march 2025.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: carleebludovika.pages.dev

Source: carleebludovika.pages.dev

2025 Corporate Estimated Tax Due Dates Laura, The amendment specifically targets employers who faced technical difficulties in filing returns between 1st march 2025 to 31st march 2025.

Source: erichabregine.pages.dev

Source: erichabregine.pages.dev

When Are Corporate Tax Returns Due 2025 Dotty Gillian, When a filing due date falls on a.

Source: sadyeyrandie.pages.dev

Source: sadyeyrandie.pages.dev

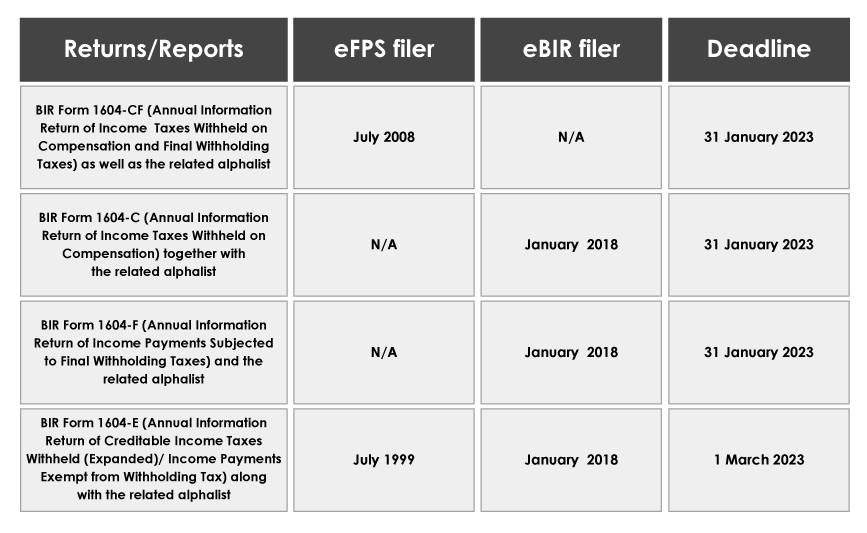

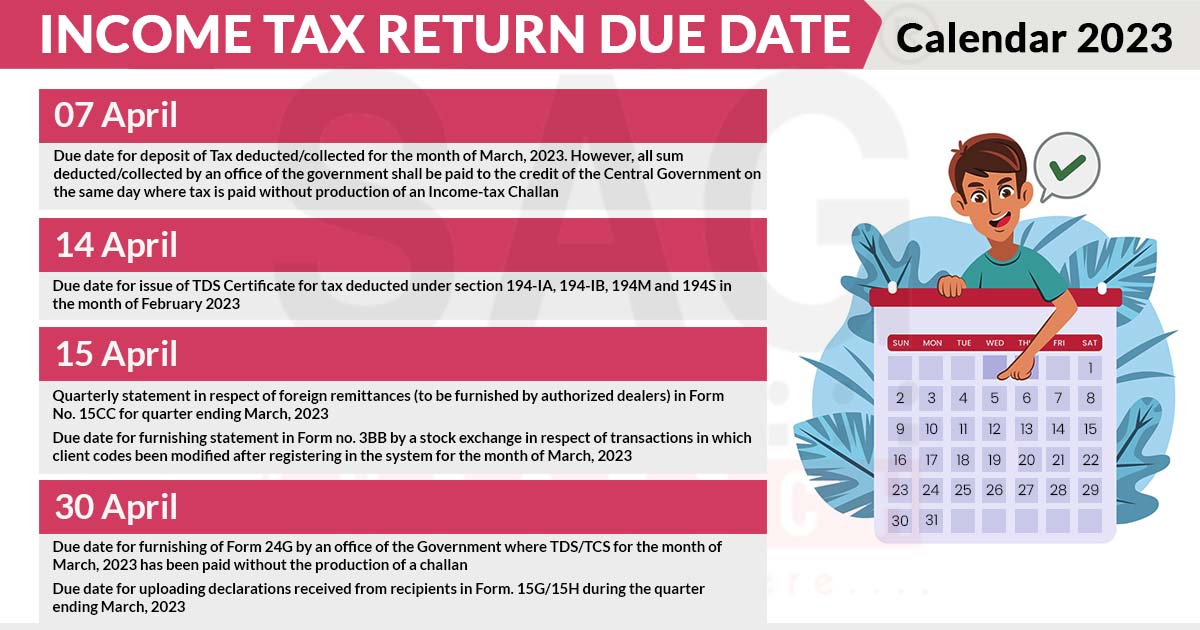

S Corporate Tax Return Due Date 2025 India Devan Missie, Due date for deposit of tds when ao has permitted quarterly deposit of tds under section 192, 194a, 194d or 194h.

Source: imeldabtamiko.pages.dev

Source: imeldabtamiko.pages.dev

Quarterly Tax Payments 2025 Due Dates In India Nelie Clarabelle, Whether your tax liability is under or over rs.

Source: chadbgisella.pages.dev

Source: chadbgisella.pages.dev

Corporate Tax Return 2025 Due Date 2025 India Raina Chandra, You can file the said returns electronically on the departments website by april 30th, 2025, without paying late fees applicable.

Source: ricayjoyann.pages.dev

Source: ricayjoyann.pages.dev

S Corporate Tax Return Due Date 2025 Ambur Mireille, Xxxii of 2025 (english) amendment to profession tax act 1975, section 27a (exemption to capf) (english) / (35.47.

Source: periaykathleen.pages.dev

Source: periaykathleen.pages.dev

Corporate Tax Return 2025 Due Date 2025 India Gustie Xylina, Learn about the analysis of rule 11, including returns, payments, and due dates.

Source: carta.com

Source: carta.com

Business Tax Deadlines 2025 Corporations and LLCs, The content on this page is only to give an overview / general guidance and is not.

Category: 2025